Polymers like polyethylene, polypropylene, polyvinyl chloride and polyester have become ubiquitous in manufacturing. The properties of polymer-based materials that make them so desirable — they are generally cheap to produce and boast high chemical and thermal stability — also make them abundant, disposable and, in many cases, non-degradable. As landfill space decreases, and with some European countries taking measures to completely banish these materials from landfills, many companies see an opportunity to capitalize on these waste streams by converting them into something more valuable. Taking advantage of the availability of post-consumer and post-industrial waste, new technologies for recycling are being developed globally. This article examines some of the technologies aimed at recycling and repurposing polyolefins, vinyls and textiles, as well as some of the challenges facing the recycling industries.

|

Re-energizing polyolefins

Often, waste materials are incinerated to generate heat and electricity, but polyolefins can actually provide much richer end-of-life options. Vadxx Energy LLC (Cleveland, Ohio; www.vadxx.com) hopes to create a new destiny for end-of-life polyolefins. In January, the company received financing to build a commercial-scale plant in Akron, Ohio, which will convert non-hazardous, post-industrial polyolefin waste (that would otherwise end up in landfills), from sources including wiring insulation and spent industrial absorbents, into energy products. The main commercial end products are additives (for ultra-low-sulfur diesel or distillate fuels) and waxes (Figure 1). The recycling process also creates fuel gas that can be used for heating requirements elsewhere in the process.

After more than three years of successful pilot-plant operation, the technology will be scaled up by a factor of 50 at the new facility, with startup scheduled for 2015. The plant is designed to process around 55 metric tons (m.t.) per day of waste, which corresponds to nearly 300 bbl/d of diesel additives.

Rockwell Automation Global Solutions (Milwaukee, Wisc.; www.rockwell.com) secured a $15 million contract for the provision of engineering, procurement, construction and management services for Vadxx’s facility. Rockwell has also developed a standard, modular design based on this plant for future construction and licensing. “The Vadxx technology of transforming end-of-life plastics into higher-value energy products is an effective sustainability solution with global implications,” says Terry Gebert, vice president and general manager, Rockwell Automation Global Solutions. “Our process and automation engineering expertise, coupled with our process automation system, will provide the necessary tools to drive success. By utilizing our multi-discipline control platform to deliver an integrated smart plant for Vadxx, it will enable them to rapidly deploy this technology globally.”

In development for over seven years, the Vadxx process consists of a series of standard unit operations (heating, cleaning and cooling) in a continuous, progressively zoned system. There is no combustion occurring in the system; rather, materials are melted and boiled under controlled environmental conditions. The subsequent thermal decomposition of these liquids results in hydrocarbon vapors that are condensed into the various products.

Upon commercial success at the new plant, the next steps for Vadxx will be to increase its breadth of feedstocks to include post-consumer waste, and to move the technology closer to the materials’ point of generation to simplify transportation and logistics. By expanding its feedstock capabilities and moving into post-consumer waste-processing, Vadxx doesn’t see its technology as a competitor to traditional polyolefin recyclers, more of an augmented or complementary process, says Jeremy DeBenedictis, vice president of operations and engineering. Vadxx’s feedstocks are focused on difficult-to-recycle materials, including those that are contaminated or off-specification, which cannot be accepted by conventional recycling processes.

Solving a PVC problem

Polyvinyl chloride (PVC) is notoriously difficult for recyclers to process when mixed with other materials. According to guidelines published by the Association of Postconsumer Plastic Recyclers (APR; Washington, D.C.; www.plasticsrecycling.org), PVC is considered to be a contaminant in facilities that process typical plastic bottles, such as those constructed from polyethylene terephthalate (PET) or high-density polyethylene (HDPE) materials. And conversely, the presence of PET (even in minute amounts) can severely hinder some PVC-recycling processes. Despite some of the inherent challenges in recycling PVC, VinylPlus (Brussels, Belgium; www.vinylplus.eu), a European organization consisting of many vinyl producers and recyclers, has set forth a goal among its members to develop innovative technologies that will result in the recycling of 100,000 m.t./yr of PVC, leading up to a target of 800,000 m.t./yr of PVC being recycled by 2020. Meeting recycling goals for PVC and other waste materials is crucial in Europe, where nine countries have landfill bans in place.

|

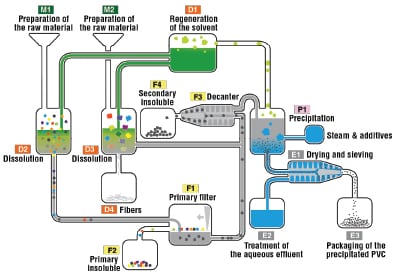

| FIGURE 2. The VinyLoop recycling process is highly selective, even when contaminants are present in the feed Source: VinyLoop

|

One company that is contributing to the goals of VinylPlus is VinyLoop Ferrara S.p.A. (Ferrara, Italy; www.vinyloop.com), a partnership between Solvay and Serge Ferarri. VinyLoop specializes in the physical recycling of post-industrial composite PVC waste that cannot be recycled using traditional mechanical processes, often due to contamination from glue, polyester, metals and polyolefins. Currently, VinyLoop operates a plant in Italy that treats 10,000 m.t./yr of PVC scraps, much of which comes from discarded electrical cables. The VinyLoop process (Figure 2) is solvent-based, consisting of dissolution, filtration and centrifuge steps, resulting in a recycled PVC (R-PVC) micro-granular product with a quality similar to that of “virgin” PVC.

At its site in Italy, the company has also inaugurated the newer TexyLoop technology, which processes textiles coated with PVC, such as advertising banners and tarpaulins — even fabrics used in temporary structures at London’s 2012 Olympic Games. Sorted and shredded fabric materials are shipped to the site, from collection depots across Europe and as far away as Australia, and are fed to the recycling process, where the fibers are dissolved, filtered and extracted, resulting in R-PVC and recycled polyester fibers. The fibers can be used in the production of heat and sound insulation, water-retention membranes, clothing and home furnishings.

As of now, TexyLoop is the only commercial recycling process for flexible PVC-coated composite textiles. The company estimates that it processes 4 million m2/yr of fabric. Life-cycle assessment studies show that the TexyLoop process has a smaller environmental footprint than simply incinerating waste textiles. In the future, VinyLoop hopes to license both of its PVC technologies to clients who have an abundance of PVC waste, or those that use PVC as a raw material.

A second life for textiles

In addition to the TexyLoop process, technologies from other companies are looking for ways to utilize textile waste, as production and disposal of these materials continues to rise. According to the Fiber Economics Bureau (Arlington, Va.; www.fibereconomics.com), worldwide annual production capacity for textile fibers has increased five-fold over the last 10 years.

|

|

FIGURE 3. The proprietary chemical process behind Teijin’s Eco Circle technology creates recycled

polyester fibers that are of equal quality to polyester produced from all-new materials Source: Teijin

|

One solution is found in the Eco Circle technology (Figure 3) from Teijin Ltd. (Tokyo, Japan; www.teijin.co.jp), which recycles polyester fabrics through a closed-loop proprietary chemical process — the first of its kind in the world, says the company. Eco Circle’s process chemically decomposes polyester and converts it back into polyester. Also, according to Teijin, the Eco Circle technology requires less energy and produces fewer emissions than producing new polyester fibers from petroleum.

The main source of waste polyester for Eco Circle is worn-out clothing, which is collected by the over 150 members of Eco Circle’s business network — mainly retail stores and apparel-producing companies. What sets Eco Circle apart is the repeatability of its technology. Rather than “downcycling” to lower-quality products, the Eco Circle process allows for polyester to be recycled multiple times into usable textiles, such as uniforms for factory employees.

In a partnership announced in December 2013 with Fuji Xerox Co., Ltd. (Tokyo; www.fujixerox.com) and Shanghai’s Onward Trading, a designer and manufacturer of uniforms, Teijin has applied the Eco Circle process to provide uniforms made of recycled polyester to workers at various Fuji Xerox facilities in China. Once the uniforms reach the end of their useful lives, they will be sent to the new recycling plant of Zheijiang Jiaren New Materials Co., a joint venture between Teijin and the Jinggong Holding Group that was established in September 2012. When this new recycling plant starts up later this year, the polyester recycled there will be eventually used to again manufacture uniforms for Fuji Xerox, closing the loop. The next step for Eco Circle will be increasing its network to integrate not just polyester from fibers and fabrics, but from other sources, such as plastic bottles and films.

Post-consumer challenges

Despite the boom in innovative recycling technologies, concerns loom on the horizon for both manufacturers and recyclers. As environmental regulations continue to tighten, new developments in bio-sourced and degradable chemicals are coming to the forefront and changing the landscape of polymer processing. The APR has published guidelines related to end-of-life options for bio-based and degradable plastics, which in many cases cannot be processed in the same manner as conventional plastics. Plastics Recyclers Europe (PRE; Brussels, Belgium; www.plasticsrecyclers.eu) also warns of the concerns related to the recycling of such materials by emphasizing that specific end-of-life solutions must be implemented on a large scale in order to truly evaluate the sustainability of manufacturing these alternative materials.

First, an important distinction must be made between “bio-based,” “biodegradable” and “degradable” materials. Bio-based products involve monomers that were originally sourced from plants or other biological raw materials. Most bio-based plastics are physically the same as their conventional petroleum-based counterparts (for instance, PE or PET) — being bio-based doesn’t make them inherently more biodegradable. Although some bio-based plastics are biodegradable, recycling solutions must be developed for those that are not. European Bioplastics (Berlin; www.european-bioplastics.org) states that bio-based plastics can be recycled in the same existing streams as their petroleum-based analogs, and reiterates that sorting technologies are sophisticated enough to prevent entry into recycling streams of bioplastics for which there is no existing recycling process. For those materials, recycling streams are being researched and can be implemented at a large scale once commercial volumes of bioplastics increase, says European Bioplastics. The most serious concerns arise with so-called oxo-degradable plastics.

An oxo-degradable plastic involves special additives that contribute to its breakdown, usually via a triggered chemical reaction. When present in batches of traditional plastics intended for recycling, materials with these additives can create issues in recycling processes, if the degradation reaction is triggered, and can also compromise the service-life integrity of recycled end products. According to the European Plastic Converters (Brussels Belgium; www.plasticsconverters.eu) trade association, even in volumes as small as 2%, degradable plastics can be significantly detrimental to the quality of recycled materials. This is especially concerning in the case of recycled materials intended to be used for long-lifetime end products, such as HDPE pipes or geotextiles used for highway construction, because the risk for degradation creates liability. Part of the problem is a lack of transparency, says APR’s technical director, David Cornell, as plastics with degrading additives are not readily identified as containing the additives. “Plastics recyclers do not know if a given package contains the additives or not and are reluctant to knowingly use a category of packaging known to include the additives,” says Cornell. He goes on to explain that the APR provides testing guidelines and protocols for companies who produce polyethylene, polypropylene and PET with degradable additives. The intent is to give companies the ability to evaluate the feasibility of using their products for certain recycled applications. European Bioplastics concurs, also emphasizing the importance of adequate labeling for bioplastics and degradable plastics for recycling purposes. Nonetheless, alternative plastics with biological or degradable characteristics will be an important piece of the plastics industry, and recyclers and manufacturers will likely need to work together toward feasible end-of-life solutions.

Looking ahead

While there are an increasing number of new processes for recycling polymers, the reality is that a majority of recyclable materials still end up in landfills or get incinerated, due to logistical or geographical issues, lack of awareness and a lack of appropriate, readily available processing facilities. Plastics Europe (Brussels, Belgium; www.plasticseurope.org), a trade association representing Europe’s plastics industry, has embarked on an ongoing project called “Zero Plastics to Landfill.” As the name suggests, this ambitious project aims to completely banish plastics waste from European landfills by 2020. Obviously, as plastics manufacturing and consumption continues, this challenge will fall mainly in the hands of recycling companies. New innovations and support for recycling will ne needed. The technologies and processes covered here are just a small portion of the recycling capability in the industry today. Companies will continue find innovative ways take advantage of these abundant and valuable waste feedstocks.