The realization that our natural resources are not endless, and that we need to focus on sustainability is driving technology and its supporting funds toward new choices. In the chemical process industries (CPI), engineers are looking for alternatives to the traditional fossil-fuel-based chemistries, and are developing innovative bio-based routes to meet our needs. There is much evidence of this shift to a bio-based economy, including the work of two of the recipients of this year’s Presidential Green Chemistry Awards in the U.S. (see p.11). Work on bio-based processing is a global undertaking, and in this Newsfront we focus on innovative bio-based technologies from the Netherlands.

The Dutch approach

Innovation, energy security and environmental concerns (particularly greenhouse gases) are some of the drivers leading to a bio-based economy, says Cornelis Mijnders, senior policy officer of the Dept. Bio-Based Economy in the Netherlands. In fact, the push to a bio-based economy is so strong that the “chemicals” sector in the Netherlands-defined “top sectors” has been re-defined to be chemicals and bio-based industry. In the Netherlands, various government agencies have a combined funding of €1.5-billion per year slated for investment in innovative technologies in nine top sectors — one of which is chemicals and bio-based industry. Each sector submits proposals for the funding through a team whose members represent industry, science and the government. Renée Bergkamp, director general of innovation at the Ministry of Economic Affairs, Agriculture and Innovation is the government official for the chemical and bio-based industry sector. She expects that decisions about the distribution of funds will be made next month.

Mijnders says that bio-based processes are moving toward second-generation feedstocks. While the distinction between first and second-generation feedstocks is usually thought of as edible versus non-edible materials, Mijnders says there are additional factors that distinguish between the two, including the type of technology used and greenhouse gas considerations. He estimates that the current investment in innovative bio-based projects in the Netherlands is about €450-million per year — approximately €150-million from government resources and €300-million from private funding. Some of that funding is going to open source pilot facilities, such as the AlgaePARC in Wageningen University.

|

Algae reactors

Algae offer great promise as versatile and sustainable raw materials for a wide-variety of applications including biodiesel fuels, degradable plastics, natural pigments and food products (see Pond Strength, Chem. Eng., September 2008, pp. 22–25). Algae transform light, carbon dioxide and minerals into a biomass that can be harvested and separated into components such as oils, protein, starch and pigments. In addition, since algae convert CO2 to oxygen, they are attractive because large-scale cultivation can have a positive effect on the overall CO2 balance.

The high expectations from algae as raw materials are dependent on the ability to economically produce algae in large quantities. To this end, a new research facility designed to explore the industrial production of algae was opened in June at Wageningen University & Research Centre (Wageningen UR; Wageningen, the Netherlands; www.wur.nl). Called AlgaePARC, this facility bridges the gap between laboratory research and industrial production with four different algae-reactor systems on a semi-industrial scale (24 m2). These cultivation systems will be studied and monitored for cost, efficiency and sustainability. The goal is to raise the sustainable output of algae bioreactors while “dramatically” lowering the production costs.

René Wijffels, chair of the Bioprocess Engineering Dept. at Wageningen UR, heads the AlgaePARC program. He says that current production costs for algae are around €25–50/kg of biomass, and that with present technology that cost could be reduced to about €4/kg. Based on theoretical process designs, Wijffels expects that a level of €0.40/kg of biomass is achievable, and that is a target for AlgaePARC’s work.

Wijffels explains that the four reactor designs were chosen based on current knowledge in the field, and that all have pros and cons (Table 1).

| Table 1. Advantages and Disadvantages of the Four Algae Reactor Types | ||||

| Raceway Ponds | Horizontal Tubes | Vertical Tubes | Flat-plate Reactors | |

| Inexpensive to build | yes | unknown | unknown | unknown |

| Easy to scale up | yes | yes | yes | no |

| Good process control | no | yes | yes | yes |

| Maintain purity | no | yes | yes | yes |

| Optimum light intensity | yes | no | yes | yes |

| Low footprint | no | no | yes | yes |

| Maintain water level (no evaporative losses) | no | yes | yes | yes |

| Low-cost to circulate fluids | yes | no | no | no |

| Maintain good gas balance (no O2 buildup) | yes | no | no | yes |

The open pond or “raceway” ponds are shallow (since light does not penetrate deeply into the algae), annular channels that use paddlewheels for mixing. These are the most common algae cultivation systems in use today. A main advantage is that they are inexpensive to build. Disadvantages include evaporation of water, and difficulties in keeping out unwanted species and controlling the process. The open structure of these systems makes them susceptible to infections and limits the choice of algae to fast-growing, resistant strains. Another disadvantage is the large footprint needed for scaleup.

Horizontal tube reactors (Figure 1) are single layers of clear horizontal tubes through which the algae are circulated. Advantages are that the productivity per surface area is higher than in an open pond, process control is better because it is in a closed loop, and scaleup can be fairly straightforward by extending the length of the tubes. A main disadvantage with horizontal tubes is the high intensity of light on the tube surface, which can be detrimental to algae growth. Additional disadvantages are the cost of circulating the fluid in the tubes and the O2 buildup in the closed loop that can slow algae growth.

Vertical tube reactors are basically vertical rows of horizontal tubes. This configuration greatly decreases the very high-intensity light associated with horizontal tubes, and decreases the footprint needed with horizontal tubes.

Flat-plate reactors (Figure 2) consist of a series of flat, parallel plates in a closed reactor system. These large polymeric “bags” are filled with water and form a big heat sink so that temperature control is an advantage in this system. The flat-plate reactors also afford some of the same advantages of the other closed systems, namely better process control and purity. Good mass transfer is obtained by sparging air in the panels, so O2 buildup is not a problem. Scaleup of this system is, however, complex.

The tube diameter of the systems in AlgaePARC is 5.5 cm — “large enough to prevent blockages and small enough for good heat transfer”, Wijffels explains. Density measurements are used to detect when the algae are ready for harvesting, which is typically done by circulating the biomass to a centrifuge.

While fouling can be a factor in all of these systems, Wijffels says that it depends on the type of algae used and how the algae are treated. Stresses, such as large temperature swings can cause a sticky substance to be secreted. Beads, however, can be used in circulation loops to help clear fouling.

Within a couple of years, the AlgaePARC team hopes to have learned enough from these four reactors to build a fifth, optimized system.

Lactic acid and PLA

Polylactic acid (PLA) is a bio-based plastic that is a sustainable alternative to oil-based polymers, and the demand for PLA’s monomers, lactic acid and lactides, is rising (see Bio-Based Chemicals Positioned to Grow, Chem. Eng., March 2011, pp. 19–23). Rop Zoetmeyer, CTO of Purac (Gorinchem, the Netherlands; www.purac.com), says that the market for PLA is estimated to reach over three million tons in the next ten years. Purac, a subsidiary of CSM N.V. (Diemen, the Netherlands; www.csm.nl) is a market leader in lactic acid production.

Zoetmeyer says that Purac’s technologies comply with the cradle-to-cradle concept, and that sustainability is key for bio-based chemicals. Purac is currently working on two projects toward lowering its eco-footprint — which Zoetmeyer explains means more than just a favorable CO2 footprint — for lactic acid production: a gypsum-free lactic acid process; and a process using alternative, non-food raw materials.

A gypsum-free process. In the current process, carbohydrates are fermented to produce lactic acid. Lime is added for pH control, and then sulfuric acid is added to convert calcium lactate into lactic acid and gypsum (CaSO4) as a byproduct. A separation step removes the gypsum and biomass and a subsequent purification separates out the lactic acid residue and yields the purified lactic acid. In the new process, neither lime nor sulfuric acid are used, eliminating the formation of gypsum and the associated steps to remove it. The result is a much simplified process.

This patented, gypsum-free process has been run on a demonstration scale for two years, and scale up to a production-scale plant is planned. The site of the new plant is expected to be chosen by the end of 2011.

Non-food substrates. In order to move away from competing with potential food sources for carbohydrates and sugar, Purac is working on using non-food substrates, such as corn stover or bagasse. The company’s goal is to have a commercial plant for producing PLA monomers using non-food substrates in 2015. The location of the plant will, in part, depend on the availability of the substrate chosen.

New bioplastics

Avantium (Amsterdam, the Netherlands; www.avantium.com) has developed a patented process to produce furanic building blocks, tradenamed YXY, that can be used for new, bio-based plastics. Using high-throughput experimentation technology, the company has identified catalysts that can convert carbohydrates into furanic molecules in a very selective and fast way, it says. Since the process is a catalytic one, it can utilize existing CPI infrastructures without the need for fermentation equipment.

The building block that Avantium has focused on to date is 2,5-furandicarboxylic acid (FDCA), which is a five-carbon-ring monomer that can be used for the production of the polyester polyethylene-furanoate (PEF). PEF is expected to compete with polyethylene terephthalate (PET), which is made from the six-carbon-ring monomer purified terephthalic acid (PTA), in applications such as beverage bottles, other packaging materials, diapers, carpets and textiles.

Frank Roerink, Avantium’s CFO, says that PEF can compete with PET on both price and performance, while offering a better environmental footprint, in part because it is bio-based and 100% recyclable. In fact, PEF is said to be superior to PET in several properties, including lower permeability of oxygen, CO2 and water, and an enhanced ability to withstand heat. Roerink says that the cost to produce FDCA is expected to be below $1,200 per metric ton (m.t.) when produced on a commercial scale, whereas the current price of PTA is $1,500/m.t., with a five-year trading average of about $1,200/m.t.

Avantium announced in June that it has raised €30 million for the construction and operation of a pilot plant in Geleen, the Netherlands, and for the development of materials based on YXY building blocks. This funding includes €25 million from investors, as well as a €5-million subsidy from the Dutch Ministry of Economy, Agriculture and Innovation. The pilot plant is expected to yield around 40 m.t./yr of FDCA in 2011, and a plan is under review to go to a larger scale in 2013. The goal of the pilot plant is to prove the process, as well as to supply material for application development. Roerink explains that Avantium’s business model is as a technology provider, so they would not produce PEF themselves, but would license the technology for it.

The company is also looking to pursue other YXY-based materials, such as polyamides (nylons and engineering plastics), polyurethanes (foams), thermosets (resins, coatings and adhesives) and plasticizers.

Renewable paths to biomethanol

BioMCN (Delfzijl, the Netherlands; www.biomcn.eu) has developed a patented process to produce biomethanol from crude glycerin. Since crude glycerin is a byproduct of biodiesel production, and that production has been increasing, new outlets for glycerin use are welcome (For more on glycerin, see Outlets for Glycerin, Chem. Eng., September 2007, pp. 31–37). According to BioMCN, they are the first in the world to produce and sell industrial quantities of high-quality biomethanol, and the largest second-generation biofuels producer in the world.

Rob Voncken, CEO of BioMCN, defines first-generation biofuels as those made from crops, and second generation as those made from waste or residue raw materials. He explains that crude glycerin is considered a residue as defined by the European Union’s Renewable Energy Directive (RED) and that the RED sets an ambitious target for the E.U.: that by 2020, at least 10% of energy used in transportation will be from renewable resources. While introduced in 2008, the RED has not yet been implemented. The methanol market, however, is developing quickly in countries such as China, where most of the automobiles are multi-fuel (also called flexi-fuel) and can use methanol or ethanol, says Voncken. The biomethanol produced by BioMCN has the same specifications as methanol, so there is a low introduction barrier to users.

In 2006, BioMCN purchased a conventional methanol plant in the northern part of the Netherlands. The traditional method for making methanol at that plant was to convert non-renewable natural gas. BioMCN modified the existing steam reformers to partly replace natural gas with glycerin as a raw material.

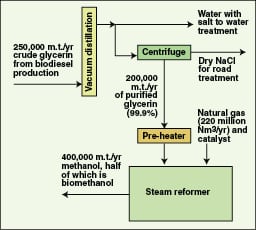

In BioMCN’s process, the crude glycerin is first purified by distillation, and then pre-heated before adding it to the steam reformer (Figure 3). After a pilot-scale demonstration in 2008, commercial-scale production started in 2009. The current capacity for methanol production at Delfzijl is 400,000 m.t./yr, half of which (200,000 m.t./yr) is biomethanol. An increased capacity to a total of 400,000 m.t./yr of biomethanol is planned by 2013. BioMCN has also developed its own catalyst, which it expects to patent.

Woodspirit. Another project in the early stages for BioMCN involves producing biomethanol from waste wood, via a bio-syngas route. To do this, the company together with the Investment and Development Agency of North Netherlands (NOM), Linde, Siemens and Visser Smit Hanab have formed a consortium that plans to build “the world’s largest” biomass refinery next to the existing biomethanol plant in Delfzijl. The planned biomass refinery will process approximately 1.5 million m.t. of residual wood to yield more than 400,000 m.t./yr of second-generation biomethanol. Termed, “Woodspirit”, the project has been selected as one of three projects submitted by the Netherlands to the E.U. for the European NER300 investment subsidy program, which aims to stimulate investments in innovative, renewable energy technology and carbon capture and storage (CCS).

“We appreciate the importance that the European Committee attaches to the reduction of CO2 emissions and the stimulus to produce and use renewable energy. With this consortium we want to make a significant contribution to the availability of second generation biofuels throughout Europe”, says Voncken. He expects that decisions about which projects are chosen for the subsidy will be made in the second quarter of 2012.

Dorothy Lozowski